Ever since Nvidia first revealed to the world how much it expects to profit from the rise of artificial intelligence in May 2023, the chipmaker has been the poster child of the AI-fueled stock market rally that has propelled the S&P 500 to historic highs.

So much so, in fact, that each of the company’s earnings releases since then has been considered a make-or-break moment for market momentum, with investors around the world biting their nails, hoping for more positive news from the company that quite literally powers the AI revolution.

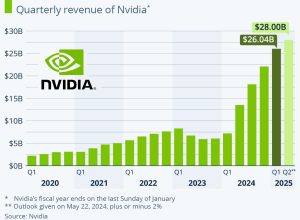

And so far, Nvidia has always delivered. On Wednesday, the company reported results for the first quarter of its fiscal year 2025 that not only met its bullish outlook from three months ago, but blew past it. Perhaps more importantly though, the company‘s outlook for the ongoing quarter promises more of the same, i.e. another jump in revenue at a very high gross margin.

In the three months ended April 28, 2024, Nvidia’s revenue jumped 262 percent from the same period a year ago, reaching $26.0 billion compared to its own outlook of $24 billion.

Once again, Nvidia’s data center business was at the heart of the company’s blowout quarter, as it saw a 427-percent jump in revenue versus a year ago and accounted for more than 85 percent of total sales.

Net income amounted to $14.9 billion in the past quarter, exceeding the full-year profit for fiscal 2023 by more than 200 percent, thanks to a gross margin of 78 percent.

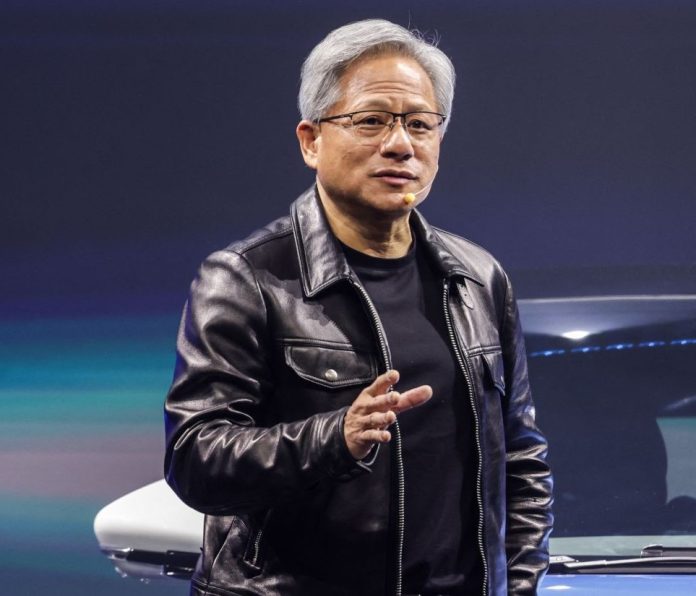

“The next industrial revolution has begun; companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center – AI factories – to produce a new commodity: artificial intelligence,” Jensen Huang, founder and CEO of Nvidia, said in a statement.

“AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities,” he added.

To further please shareholders and keep its stock accessible to employees and retail investors, Nvidia also announced a 10-for-1 stock split. The company’s stock price has surged roughly 240 percent over the past year, propelling its market capitalization to more than $2.5 trillion.

Felix Richter writes for Statista