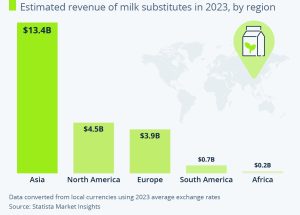

Asia is the global trailblazer of plant milk substitutes.

According to data from Statista’s Market Insights, the region was estimated to pull in a revenue of $13.4 billion in 2023. This was mostly led by China, which had an estimated revenue of $9.5 billion that year alone.

Other major markets in Asia included Japan ($1.8 billion), South Korea ($0.4 billion) and India ($0.4 billion).

Following some way behind is North America, with the United States as the region’s major market ($3.6 billion). Europe places in third position in the regional ranking, with an estimated revenue of $3.9 billion in 2023.

There, the major players were Germany ($0.8 billion), the United Kingdom ($0.6 billion) and Spain ($0.6 billion). The regional markets in South America and Africa were substantially lower in 2023, at $0.7 billion and $0.2 billion, respectively.

According to Statista analysts, the milk substitutes market will continue to expand in the coming years, reaching a global revenue of over $35 billion by 2028. While Asia will remain the market with the biggest revenue due to its sheer population size, Europe and North America will see steeper growth in terms of average revenue per capita, as milk substitutes continue to gain popularity in both regions.

Substitute milks perform differently in each market. For example, in China, soy drinks are traditionally the most popular of the plant-based milks due to a tradition of soy consumption and the plant’s availability, according to Mordor Intelligence.

In Sweden, the home turf of brand Oatly, oat milk is particularly popular; while in the United States, almond milk is the most sold plant milk.

Anna Fleck writes for Statista