Nigerian Stockbrokers have proposed strategies by which the Federal Government can deepen the capital market to achieve its proposed one trillion dollar economy.

They made the proposal in a communique signed by Mr Oluropo Dada, President/Chairman of Council of Chartered Institute of Stockbrokers (CIS), and the Registrar/Chief Executive of CIS, Dr Josiah Akerewusi.

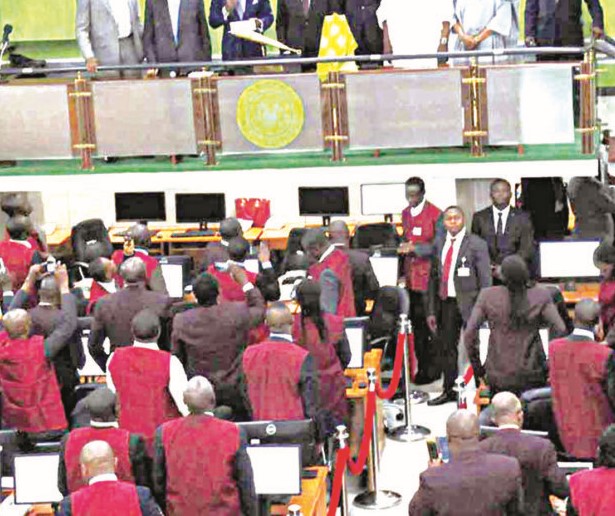

The communique was from the 28th Annual Conference of CIS held in Ibadan with the theme: “Capital Market as Catalyst for The One Trillion Dollar Economy’’.

Dada said that, if adhered to, the proposed strategies would help the government to achieve its goal without increasing borrowing.

He urged the Federal Government to list Nigerian National Petroleum Company Ltd. and moribund state enterprises on the secondary markets.

According to him, this is to deepen the markets, enhance the companies’ ability to make profit and generate revenue for the government through tax.

The CIS president also said that there was the need to rebase Nigeria’s Gross Domestic Product (GDP) to reclaim the country’s status as Africa’s largest economy to create opportunities to achieve the one trillion dollar target.

Dada urged policies that would incentivise indigenous and privatised companies as well as Small and Meduim Enterprises (SMEs) to list on the Nigerian capital market.

He said that the informal economy constituted a significant portion of Nigeria’s GDP but remained largely untapped by the capital market.

“Government should conclude the ongoing review of Investment and Securities Act while capital market regulators should review relevant rules and laws in line with global best practices,’’ he said.

According to him, this will boost investor confidence, create a favourable business environment for listed companies and remove restrictions hindering liquidity access for stockbrokers.

“The Nigerian capital market should be integrated into Fintech solutions, blockchain technology and other digital innovations to enhance accessibility, efficiency, transparency and attraction of Millennials, Gen Z, Gen Alpha, among others.

“Market operators should also develop products that attract investment appetite of the technology-savvy youths,” he said.

According to him, the government should address foreign exchange challenges and other inhibitions to participation of foreign investors in Nigeria.

“This will also enhance Foreign Direct Investment.’’

Dada said there was a huge knowledge gap among investors, urging that financial literacy programmes should be pursued with renewed vigour.

He said that financial literacy should cut across all segments of investors and would require collaboration of market regulators with all stakeholders.

He said: “The Nigerian capital market should reflect the key sectors such as agriculture, oil and gas to better align with GDP composition and provide opportunities for capital formation and mobilisation.

“Government at all tiers in Nigeria should leverage more on the capital market to raise long-term funds for infrastructure development,’’ he said.

Dada said that this should be done by issuing project-tied bonds with irrevocable standing payment order which would remove the risk of default.

“In order to relieve itself of perennial debt overhang, Nigeria should opt for debt restructuring and extension of maturity period to enable it to manage its resources for the overall development of the economy.

“On the monetary side, the Central Bank of Nigeria should intensify tight monetary policy to control inflation.

“Government should exploit opportunities in the commodities ecosystem to grow the GDP. Commodities Ecosystem remains a niche market in Nigeria.

“Government should implement the policies enunciated to strengthen commodity trading and commodity exchanges to enhance export trades, generate forex, boost external reserve and strengthen the Naira.’’

According to him, government should also implement structural reforms, including deregulation, debt management and public awareness campaigns by collaborating with the market stakeholders to unlock Nigeria’s economic potential.

Dada said that the government should put in place policies to attract private equity, venture capitalists and angel investors, adding that at all tiers of the government should leverage tariff policies to support local industries.

This, he said, would pave way for participation of private equity, venture capitalists and angel investors to support the growth of SMEs. (NAN)