Finance experts warn that if you have ever been approached to transfer money for a fee, you may have been targeted as a money mule.

“Fraudsters are always on the lookout for targets and are very sophisticated in their efforts.

“They may use emotional tactics to trick you. Never receive or send money for someone you don’t know, without knowing why or where it’s from.

“Being a money mule is a criminal offence,” finance experts say.

What is a money mule?

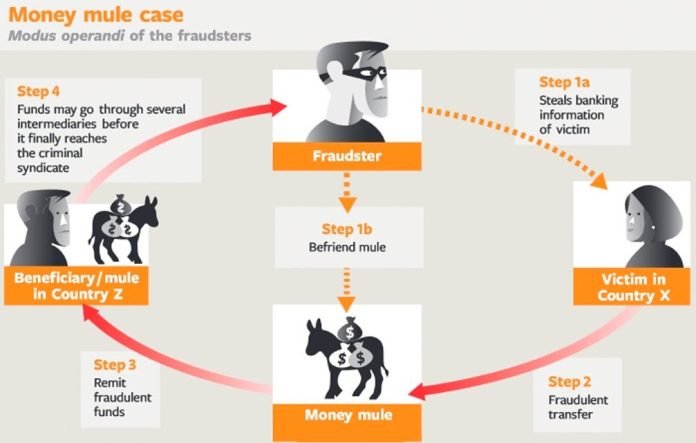

According to the Federal Bureau of Investigations [FBI], a money mule is someone who transfers or moves illegally acquired money on behalf of someone else.

Criminals recruit money mules to help launder proceeds derived from online scams and frauds or crimes like human trafficking and drug trafficking. Money mules add layers of distance between crime victims and criminals, which makes it harder for law enforcement to accurately trace money trails.

Money mules can move funds in various ways, including through bank accounts, cashier’s checks, virtual currency, prepaid debit cards, or money service businesses.

Some money mules know they are supporting criminal enterprises; others are unaware that they are helping criminals profit.

Money mules often receive a commission for their service, or they might provide assistance because they believe they have a trusting or romantic relationship with the individual who is asking for help.

If you are moving money at the direction of another person, you may be serving as a money mule.

|

Here’s how fraudsters recruit money mules

|

|

|

Through dating sites

When a trusted friendship is established, you are asked to open an account or help pay for high-value items such as airfares or medical fees.

|

|

|

|

|

Through job offers

When you receive a job offer that requires you to accept and transfer funds on behalf of the company.

|

|

|

|

|

Via E-mail

When you receive an email from a ‘friend’ asking to deposit money in your account, that subsequently needs to be transferred elsewhere.

|

|

|

|

|

Through social media

When you are targeted on different platforms with offers of ‘quick cash’ in exchange for access to your bank accounts.

|

|

|

|

|

Events

Business, networking or charity events that require you to receive and transfer funds on behalf of the ‘holding’ company or charity organisation.

|

|

|

|

How to avoid being recruited as a money mule:

|

|

Beware of people

offering fees for simply

transferring money

|

|

|

|

Never give your

bank details to someone

you do not know or trust,

especially if you meet them online

|

|

|

|

Don’t open a bank

account in your name to

receive and transfer money

for someone else

|

|

|

|

Protect your personal

and financial information,

fraudsters may use your details

to open accounts in your name

|

|

|

|

If you have been tricked into receiving or transferring money using your bank account report it to us immediately.

|

|

|

Spot – Stop – Report

|

|

Stay vigilant. If it sounds too good to be true, it usually is.

|

| Spot |

|

Spot

the warning signs

Always verify the

identity of the person

you are dealing with.

|

|

|

| Stop |

|

Stop

suspicious activity

Do not receive and

transfer funds on

someone else’s behalf.

|

|

|

| Report |

|

Report

the incident to the bank

The sooner you report it to

us, the better the chances

of stopping the fraud.

|

|

|

|